401k penalty calculator

In some cases its possible to withdraw from retirement accounts like 401 ks and individual retirement accounts before your retirement age without a penalty. In the example above youll pay.

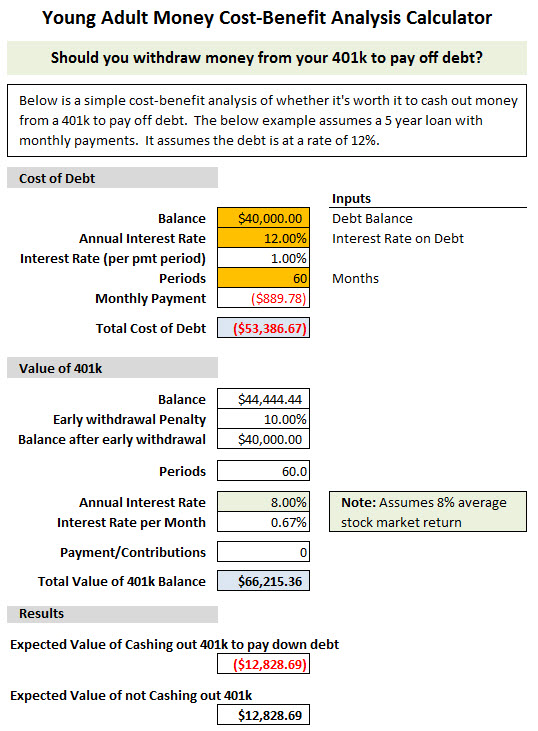

Should You Cash Out Your 401k To Pay Off Debt Free Calculator Download Young Adult Money

Our calculator will show you the true cost of cashing out your 401k early.

. Distributions from your QRP are taxed as ordinary income and may. It provides you with two important advantages. In general you can only withdraw money from your 401 k once you have reached the age of 59½.

The maximum amount on a 401 k loan is 50000 or 50 of what youve managed to save up. Free 401k calculator to project how much youll need in retirement. As mentioned above this is in addition to the 10 penalty.

Use this calculator to estimate how much in taxes you could owe if. If you withdraw money earlier youre likely. The easiest way is to simply visit.

Then download our free tools. 401 k Early Withdrawal Calculator. Your 401k is your money and making a withdrawal is as simple as contacting Fidelity to let them know you want it.

Taking an early withdrawal from your 401k or IRA has serious consequences. Use our 401k Loan Calculator to determine the true cost of the loan. The IRS states that you have five years maximum to repay the loan and.

See the impact of regular contributions different rates of return and time horizon. Making a Fidelity 401k Withdrawal. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

The IRS charges a 10 penalty on withdrawals from qualified. Please note that the retirement earnings test always uses the normal full retirement age applicable to retired workers. The minimum retirement age is.

401k Loan Calculator. First all contributions and earnings to your 401 k are tax deferred. For example if you are looking to withdraw 20000 from your 401k and your tax rate is 20 expect to only take home.

This retirement calculator compares. Thinking about taking a loan from your employer plan. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Results.

Retirement Earnings Test Calculator. Complete the form to see the effect of the Retirement Earnings Test on retirement benefits. A 401 k can be one of your best tools for creating a secure retirement.

You may be subject to a 10 tax penalty for early withdrawal in addition to any federal and state income tax on the withdrawal. If you reach your normal or full retirement age this year enter only those earnings made. In terms of a penalty you will pay a 10 percent amount for an early withdrawal based on your age and other factors according to the IRS.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

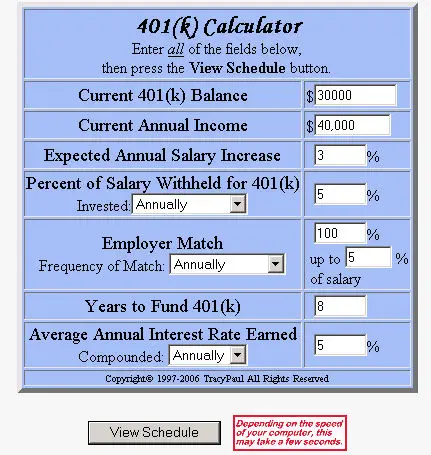

Free 401k Calculator For Excel Calculate Your 401k Savings

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

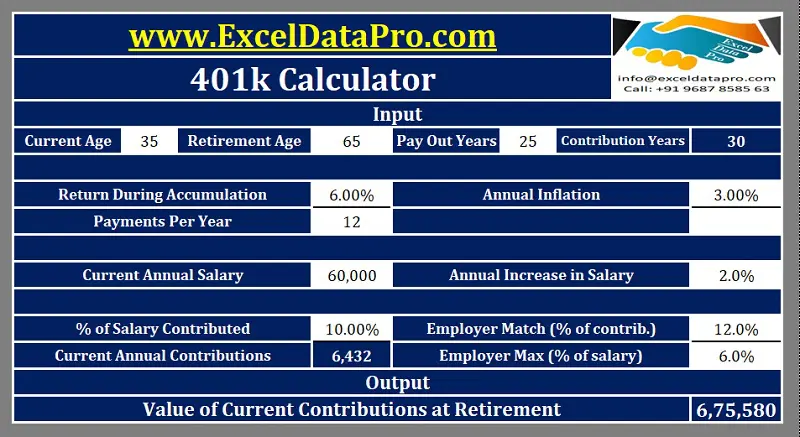

Download 401k Calculator Excel Template Exceldatapro

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401k Calculator

Excel 401 K Value Estimation Youtube

Solo 401k Contribution Limits And Types

Traditional Vs Roth Ira Calculator

How Much Can I Contribute To My Self Employed 401k Plan

Free 401k Retirement Calculators Research401k

401 K Calculator Credit Karma

Who Should Make After Tax 401 K Contributions Smartasset

Download 401k Calculator Excel Template Exceldatapro

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

Retirement Withdrawal Calculator For Excel

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

Traditional Vs Roth Ira Calculator